Standardized Card Payment Processing Flow

Payter supports the EMV method for card payments. This is a standard introduced in the 1980’s by three companies (EuroPay, Mastercard & Visa) and is used now used widely across the world by many other Card Schemes. This standard has been updated many times over the years, but the broad flow has remained the same. It enables the Authorisation and Settlement of fund transfers between Cardholders and Merchants.

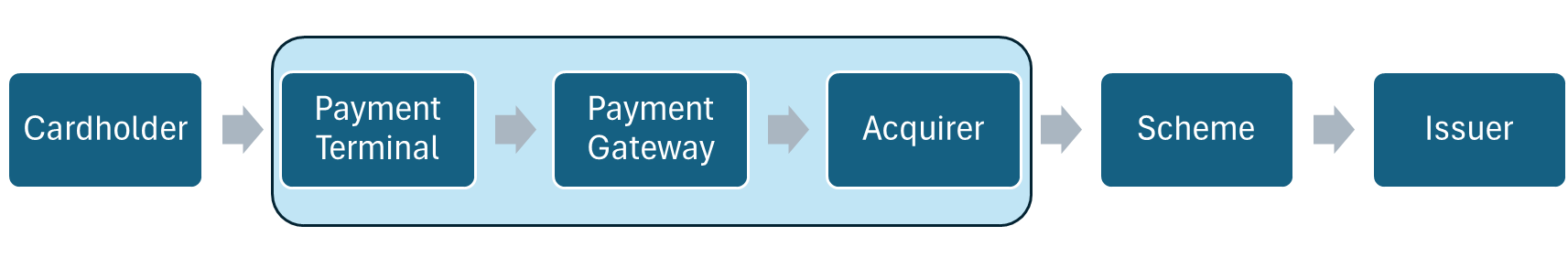

The flow for a Card Present transactions is as follows:

The Cardholder uses their EMV Card to interact with a Payment Terminal

The Payment Terminal captures the card data and securely transports it to an Acquirer

The route to the Acquirer is often via Payment Processors and Payment Gateways

The Acquirer passes the data to the relevant Card Scheme e.g. Mastercard, Visa or American Express

The Scheme passes the data to the Card Issuer, who approves or acknowledges the request

The response or approval are passed back via the Card Scheme, Acquirer, Gateway, and Processor, to the Payment Terminal

The Cardholder and Merchant are informed of the outcome by the Payment Terminal

Payter can only control or influence the areas in light blue; Payment Terminal, Payment Gateway & Acquirer.

Merchants must have a direct relationship with the Acquirer only in this flow. Many Merchants however also choose to have a relationship with the Payment Terminal provider and sometimes also the Payment Gateway. It is the Acquirer who pays, or Settles funds to the Merchant after the amount has been finalized.

Many of the terms used here can be confusing. Terms in bold are defined in our Glossary.

Unusual Exceptions

It is possible for a single entity to choose to fulfil more than one role in this flow. In EV Charging for example, it is commonplace for a Charge Point Operator to contract with a single entity who:

Provide the Payment Terminal & the EV Charger

Provide tools to allow the Charge Point Operator to manage the Charger and Terminal

Contract with the Acquirer and Payment Terminal provider (Payter) directly

Collect all the settled funds, and pay all the bills

“Settle” directly to the Charge Point Operator for the funds collected, minus a fee

The fee will include a suitable profit margin for this entity. In this case, Payter will simply manage the relationship to the entity and treat them as the merchant.